We know that you cannot outrun your risk, but you can be ready for it. What if a hurricane causes you to lose power to your building and your operations cease, or if a fire severely damages your building? You shouldn’t have to pay for this yourself, and with the right protection, you won’t have to. Our insurance advisors can help you identify gaps in coverage, look for ways to save money and keep your assets and income protected.

Directors and Officers Liability Insurance (D&O)

Directors and officers liability insurance covers directors and officers for claims made against them while serving on a board of directors and/or as an officer. We’ll work with you to protect your organization’s greatest asset: your senior leadership.

Fiduciary Liability Insurance

Fiduciary liability insurance protects individuals acting as ERISA fiduciaries against fiduciary-related claims of mismanagement of a company’s employee benefit plan. We’ll work with you to ensure that employee benefits are handled responsibly and your trustees are protected.

Errors and Omissions Liability Insurance (E&O)

Errors and omissions liability insurance protects any business that gives advice, makes educated recommendations, designs solutions or represents the needs of others. We’ll design coverage that will ensure that one simple mistake does not cause financial devastation.

Golf Course Insurance

Golf is a relaxing pastime that many people enjoy, but operating a golf course isn’t such a walk in the park! Specialty golf course insurance can protect your business from financial risks associated with property damage, extreme weather, liquor liability and much more.

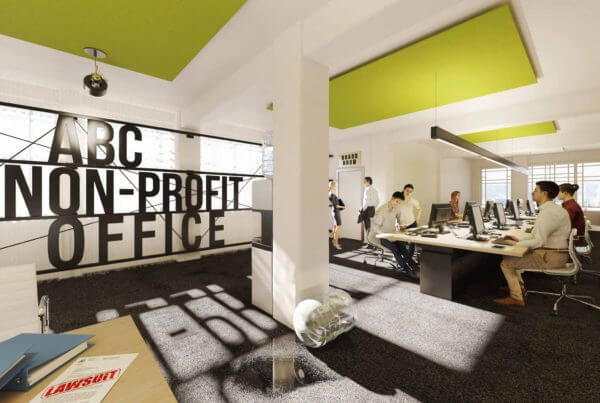

Non-Profit Insurance

Even though your organization’s goal is to help people, you are still running a business. That means your non-profit needs to protect itself against the risks that small business owners face. We’ll help you design a non-profit insurance policy that covers your organization’s unique needs.

Property Manager Insurance

If you manage residential or commercial properties, you face a diverse set of risks and potential losses. From liability issues to damage protection, we’ll help you navigate the world of property manager insurance and design coverage that’s a perfect fit.

Child Care Center Insurance

All businesses need insurance for their building, business property, and other equipment. Child care centers have additional insurance needs that relate directly to the care they provide and the young population that they serve. Whether you run your business from your home or a commercial building, consider coverage that’s specific to your needs.

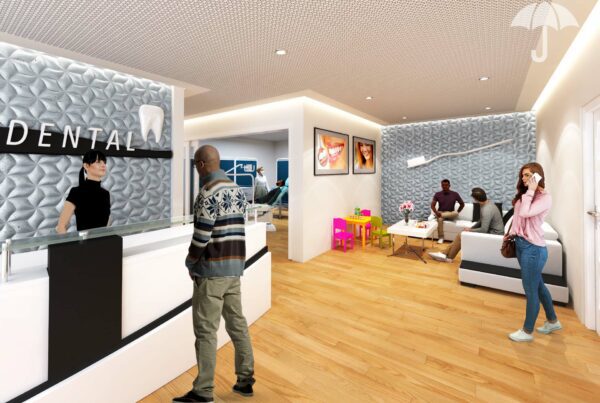

Dental Office Insurance

The work you perform has needs particular to the dental industry. In addition to the standard office equipment, your patient rooms contain highly specialized equipment. Items like X-ray machines, dental chairs, lights, sterilization equipment, and more are all quite costly to replace. It’s important to consider an insurance policy that covers the needs of your dental practice.

Landlord and Rental Property Insurance

Because properties can vary greatly in many ways, an off-the-shelf insurance package won’t likely be the right fit. Your location, building specifics, and the number of dwelling units all may factor into your insurance policies. It’s important to understand the unique nature of your risks based on the type of property you are insuring.

Municipality Insurance

A municipality doesn’t operate like most other businesses. There are multiple properties to consider, including administrative offices, school buildings, and public works, and the risks differ based on the kind of work being done inside, who is visiting, and what types of furniture, machinery, and materials it might contain. It’s vital to keep all this in mind when selecting insurance for your municipality.

Fire Department Insurance

Fire departments perform a variety of jobs in their communities. For example, this includes suppressing fires, responding to emergency medical situations, and educating the public on fire safety. With so many different functions, you’ll want insurance to help cover your department against the unique risks you face.